2024.01.02

Crude oil temporarily stopped falling, but the rebound of plastic prices is limited!

Page view:445

PP Market Review

01

PP spot market review

The PP market as a whole was stable. Recent oil prices led to the overall loosening of the cost end, cost support weakened, slightly improved demand but limited strength, futures encountered technical resistance fell, but PP maintenance is still more, inventory hit a new low, long and short interwoven PP spot prices as a whole stable, little change.

02

PP futures market review

PP futures main block fall. PP gained support at the technical support level in the early stage, and basically completed the rebound at the end of the month, encountering the previous high continuous resistance and facing falling pressure. At present, the rebound of PP technology is basically fulfilled, and the short-term or face a certain decline after being blocked here, and considering the increase in supply pressure of PP05 contracts, the overall demand is weak, and the air distribution property is expected to continue to ferment.

03

PP cost side analysis

Oil prices are volatile, with Brent trading near $80. In the early stage, oil prices fell sharply under the pressure of high inventories, but they were supported near the former low, and the Red Sea incident triggered market concerns, and oil prices stopped falling, including Brent's rebound to near $80. Although the rebound in oil prices has been blocked, the overall decline is more than the previous peak, and the depreciation of the renminbi has come to an end and began to appreciate, the cost of imports has declined, and the loss of oil PP has also improved significantly compared with the previous period, and the current loss is around 800 yuan/ton.

04

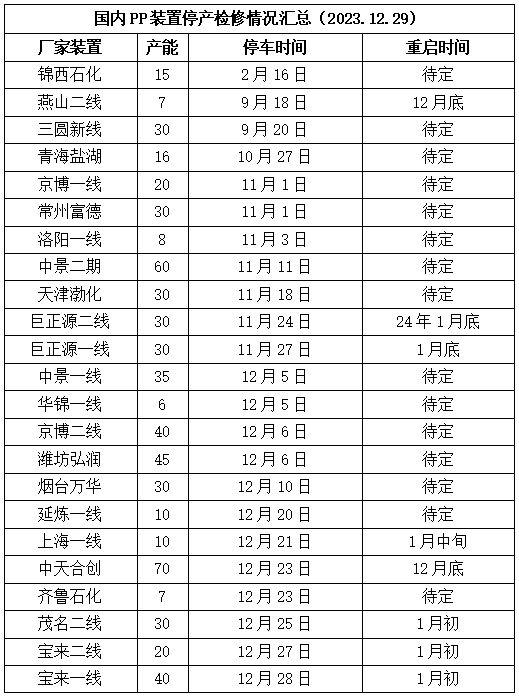

PP supply analysis - maintenance summary

5

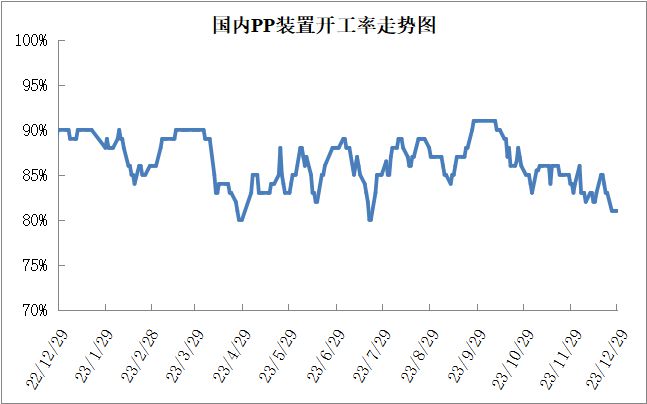

PP supply analysis - Operating rate

PP operating rate continued to be low, once fell to near 80%, still maintained below 85% low. Although PP profits have been repaired to a certain extent, the overall is still in a state of loss, coupled with weak demand, unplanned maintenance is still more, the operating rate fell to a low level near 80% in the year, and the supply pressure is greatly relieved.

06

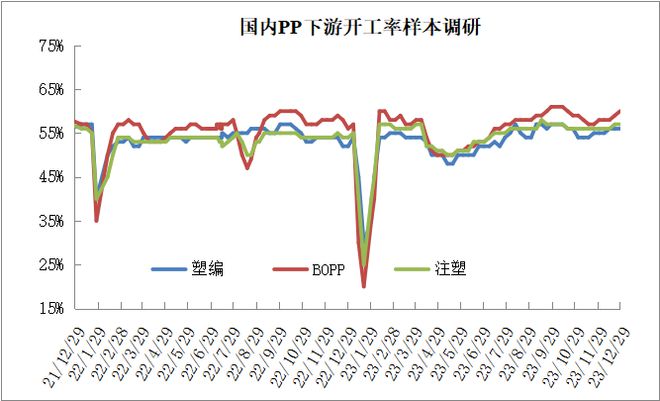

PP downstream demand analysis

P operating rate continued to low, once fell to near 80%, still maintained below 85% low. Although PP profits have been repaired to a certain extent, the overall is still in a state of loss, coupled with weak demand, unplanned maintenance is still more, the operating rate fell to a low level near 80% in the year, and the supply pressure is greatly relieved.

07

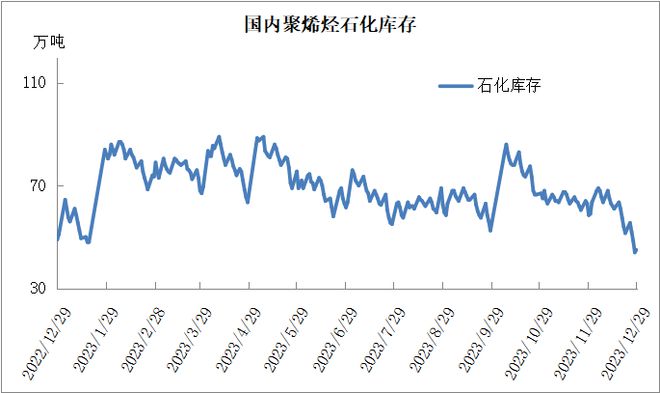

Petrochemical inventory analysis

Recently, the speed of petrochemical storage has not only hit a new low after the Spring Festival, but also a historic low since statistics. Recently, the maintenance of petrochemical enterprises has increased significantly, after PP hit a low point in the year, PE operating rate has also declined significantly, the supply has decreased significantly, and the demand has improved slightly, coupled with the assessment of two barrels of oil at the end of the month, traders have taken more goods, and accelerated petrochemical to the warehouse, but after New Year's Day or there are obvious bases.

08

PP market outlook

【 Lido 】

1. There are more unplanned maintenance of PP, and the supply pressure is significantly relieved.

2. The Spring Festival is approaching, and downstream enterprises are facing stocking up before the festival.

【 Negative 】

1.PP is still facing great pressure of capacity expansion.

2.PP loss improved and cost support weakened.

09

Sum up

At present, PP maintenance has become a greater benefit, but the late cost side support is weakened, the low operating rate is difficult to maintain for a long time after the improvement of losses, and the new device is facing production; The demand side is weak as a whole, but the downstream is expected to stock up before the Spring Festival, and demand is expected to improve significantly next month. PP futures are facing technical pullback pressure, the spot end of mid-early December or maintain weakness, but the pre-holiday stock start in the latter half of the year, PP is still expected to usher in a rebound.

PE market review

01

PE spot market review

PE ex-factory price statistics

PE market price statistics

PE market rose slightly, mainly in the range of 50-150 yuan/ton, LDPE rose more. This week, the supply pressure slightly eased, support enhanced, led by the Red Sea shipping incident fermentation, the main trend of plastics is strong, superimposed market spot is tight, traders actively push up, but the transaction continued to weaken, the basis remained weak.

North China market LLDPE mainstream 8120-8250,LDPE mainstream 8980-9150,HDPE mainstream 7900-8250; East China market LLDPE mainstream 8200-8300,LDPE mainstream 9050-9250,HDPE mainstream 8000-8200; South China market LLDPE mainstream 8300-8600,LDPE mainstream 9100-9200,HDPE mainstream 7850-8350.

02

PE futures market analysis

The main plastic rose first and then fell, the MACD index red column extended and shortened, the KDJ index turned into a dead fork after strong, the 5-day average has slowed down, and the weekly K line is longer. Good news digestion, there is no further guidance, the uncertainty during the holiday is strong, KDJ and MACD indicators suggest that plastics have a small decline space, the market mentality is bearish, L05 trend or remain weak, for reference only.

03

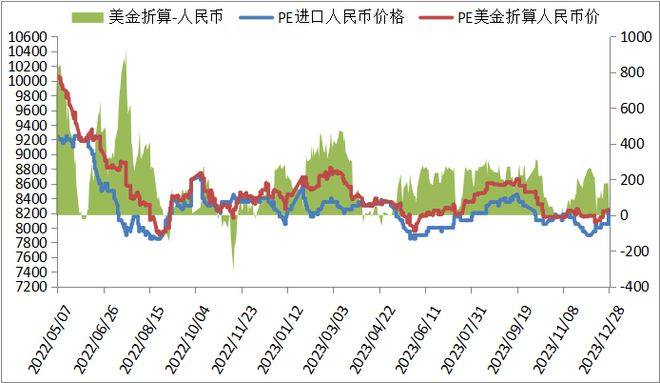

PE cost and profit analysis

Petrochemical costs and profits

The trend of international oil price futures is weak, according to Bren 78.39 at the weekend, the benchmark LL cost is about 9087, the high LL ex-factory price is about 837, and the cost support is weakened.

Import cost and profit

PE imported linear US dollar mainstream price rose slightly, 940-970 at the weekend, the converted RMB cost was 8250-8500, the market mainstream 8150-8250, the high domestic linear 100-250, the price spread widened.

04

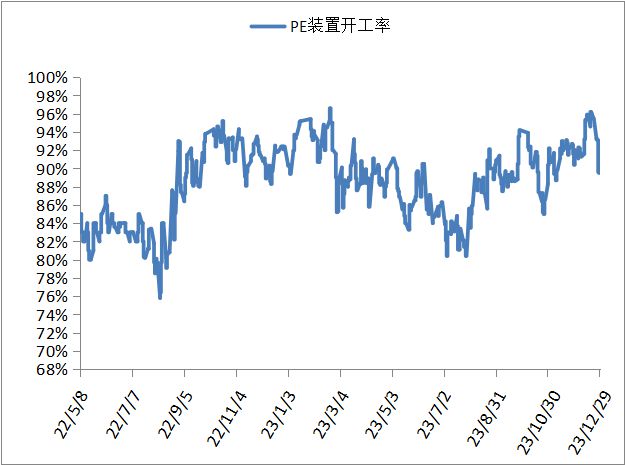

PE device operating rate analysis

Temporary parking of PE installations increased, and the on-load dropped to about 90% over the weekend, compared with -6% last week and -3% compared with the same period last year. The PE device has no planned parking or driving device, and the PE load is expected to remain high.

05

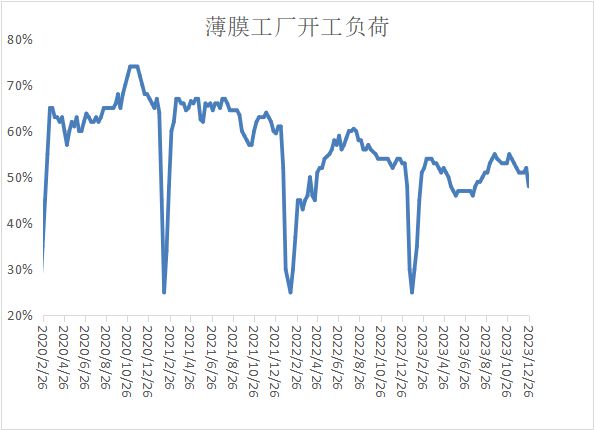

PE downstream demand analysis

Agricultural film load decreased by 2% to about 34%, the number of days of raw material inventory increased slightly, but the number of days of order was shortened, the price of agricultural film was mainly stable, the procurement enthusiasm was weak, and the procurement was maintained according to demand. Next week, the agricultural film industry load is expected to continue to decline, the demand for shed film is gradually ending, the demand for mulch film is starting slowly, and the need to maintain just the purchase continues to loosen the support of the polyethylene market.

PE packaging film load decreased slightly by 4% to 48%, the decline is large, the number of days of order and the number of days of raw material inventory increased slightly, affected by environmental protection in some areas, the load decreased faster. In the future market, new orders in the PE packaging film market are expected to be limited, trading is light, there are more finished products in the PE packaging film factory, and the starting load or maintain a small decline.

06

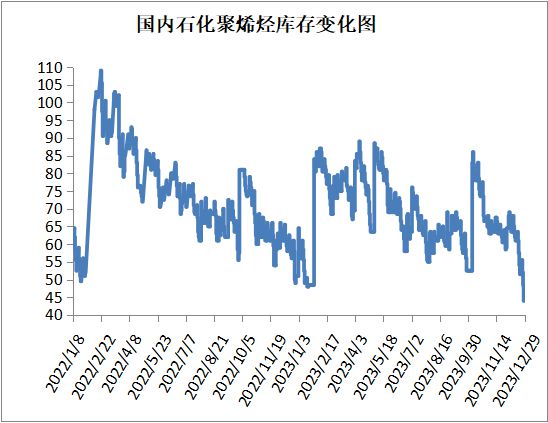

Polyolefin petrochemical inventory analysis

As of December 29, petrochemical polyolefin inventory of 450,000 tons, compared with last week - 65,000 tons, a record low within the week. Petrochemical continued to library, mainly due to the monthly planned amount of petrochemical assessment at the end of the month, followed by the tight spot market, plastic main trend is strong, stimulating some speculative demand. At the beginning of next week, the market is worried about the gradual return of supply, the downstream resistance to high prices, the wait-and-see atmosphere is also strong, traders have no assessment pressure, digest their own inventory, petrochemical inventory is expected to accumulate slightly.

07

Market forecast

1, polyethylene downstream load is expected to maintain a decline, approaching the Spring Festival, downstream factories are expected to stop work in advance.

2, the domestic load fell slightly, but the market wait-and-see atmosphere is strong at the beginning of next week, petrochemical inventory is expected to accumulate faster after the New Year holiday, supply began to return, the tight supply situation or ease significantly.

3, the supply side remains loose, the demand side remains weak, the impact of the Red Sea shipping event is weakened, the support for oil prices is weakened, and the international crude oil futures will have room to fall next week; The domestic macro surface remains warm, and there are expectations of RRR reduction in January, but it is difficult to exceed expectations.

08

Sum up

PE market uncertainty is strong, first depends on the degree of inventory accumulation of the two oil after the festival, followed by the degree of relief of market resources, and again the downstream acceptance of high prices, all have a greater impact. For the time being, the probability of weak performance is larger, and the market is also expected to fall after continuous highs. So it is expected that the PE market or a small correction.

Previous:Plastic knowledge class - HDPE...

Next:10 major events in the plastic...